Express GST Login Streamlining Your Tax Filing Process

In today’s fast-paced business environment, GST compliance is a critical aspect for companies, especially for small and medium-sized enterprises (SMEs) and micro, small, and medium enterprises (MSMEs). Managing tax returns, adhering to government guidelines, and ensuring timely submissions can be overwhelming. This is where Express GST Software comes into play, offering a robust solution to simplify the Goods and Services Tax (GST) filing process.

What is Express GST Software?

Express GST Software is an advanced and user-friendly platform designed to help businesses of all sizes manage their GST compliance with ease. This software is built to assist in every aspect of GST filing, from generating invoices to filing returns, reconciling data, and staying updated with the latest tax laws. With its intuitive interface and comprehensive features, Express GST Software allows businesses to automate complex tax processes, saving time and reducing human errors.

Businesses can easily access the software through the GST Login portal, which ensures that users have a secure and seamless experience when handling their GST-related tasks. The login portal is designed for quick access, providing users with a centralized dashboard that tracks all relevant activities, reports, and pending submissions.

Key Features of Express GST Software

- User-Friendly Interface Express GST Software is designed with ease of use in mind. Even users with minimal technical knowledge can navigate the platform effortlessly, thanks to its intuitive layout. The software provides clear instructions and tooltips, guiding users through each step of the tax filing process.

- Comprehensive GST Filing Express GST Software supports multiple types of returns, including GSTR-1, GSTR-3B, and annual returns. Users can easily upload their data, reconcile invoices, and generate accurate returns. The software also handles amendments and late submissions, ensuring that users remain compliant at all times.

- Invoice Management Generating and managing invoices is a crucial part of GST compliance. The software offers tools to create GST-compliant invoices that adhere to government regulations. Users can customize invoices, track payments, and integrate them with their accounting systems to ensure seamless operations.

- Auto-Reconciliation of Data One of the standout features of Software is its ability to automatically reconcile data. The software compares the data from suppliers and recipients to identify any mismatches, helping businesses rectify errors before filing their returns.

- Real-Time Updates Tax laws and regulations frequently change, making it essential for businesses to stay updated. Express GST Software ensures that users are always aware of the latest rules, providing real-time notifications and updates within the platform.

- Secure Login and Data Protection Security is a top priority when it comes to handling sensitive financial data. The Express GST Login portal uses robust encryption protocols to protect user information and ensure that the data is only accessible to authorized personnel.

- Multi-Device Access Express GST Software can be accessed from multiple devices, including desktops, laptops, and smartphones. This flexibility allows users to manage their GST filing process from anywhere at any time, making it a highly convenient solution for businesses on the go.

- Integrated Help Desk The platform also offers a dedicated help desk, providing users with support whenever they encounter difficulties. The integrated help center includes FAQs, video tutorials, and live support to resolve any issues promptly.

Read Also: Niloufer Hospital

How Does Express GST Software Benefit MSMEs?

For MSMEs, staying compliant with GST regulations can be both time-consuming and challenging. Express GST Software offers several advantages that specifically cater to the needs of MSMEs:

- Cost-Effective Solution MSMEs often operate on tight budgets, and hiring dedicated personnel for tax management may not always be feasible. Software provides an affordable solution by automating tasks that would otherwise require extensive manual input.

- Time-Saving Automation By automating invoice generation, tax calculations, and return filing, MSMEs can save valuable time and focus on growing their business. The software reduces the time spent on data entry and reconciliation, allowing businesses to streamline their operations.

- Error Reduction Manual tax filing is prone to errors, which can lead to penalties and legal complications. Software reduces the risk of mistakes by automating calculations and ensuring that all data is accurate and up to date.

- Compliance Assurance Staying updated with the latest tax laws is crucial for businesses, especially when penalties for non-compliance can be severe. The software ensures that MSMEs remain compliant with government regulations, providing peace of mind and reducing the risk of fines.

- Enhanced Productivity With features like real-time reconciliation and automated reminders, Software allows MSMEs to maintain a higher level of productivity. Business owners can monitor their tax status, check for discrepancies, and stay informed about upcoming deadlines, all from a single platform.

Read Also: DBS Credit Card Login

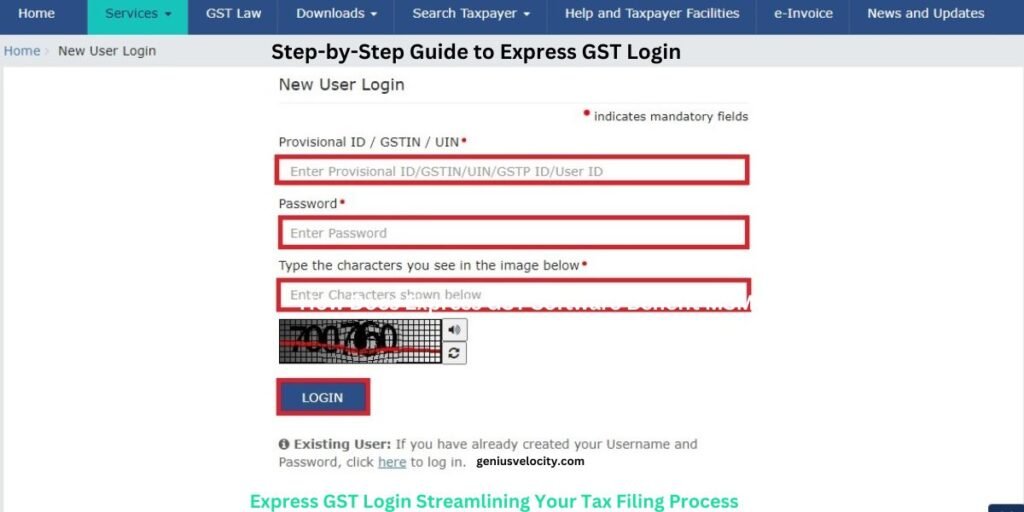

Step-by-Step Guide to Express GST Login

- Visit the Express GST Portal

To get started, visit the official website of Software and locate the login section. - Enter username and password

Provide your registered username and password. For first-time users, the software will prompt you to create a new account or reset your credentials. - Access the Dashboard

Once logged in, users are directed to their personalized dashboard, which provides an overview of their tax-related activities, pending tasks, and recent notifications. - Select the Filing Option

Choose the type of return you wish to file, such as GSTR-1 or GSTR-3B, and proceed with uploading your data. - Upload Invoices and Reconcile Data

Upload invoices, review transaction data, and reconcile any discrepancies using the automated tools available on the platform. - Submit Returns

After reviewing your data, click “Submit” to file your return with the GST portal. - Track Submission Status

Use the dashboard to track the status of your return submission and download confirmation receipts for your records.

FAQs

Is Express GST Software suitable for all business sizes?

Yes, Express GST Software caters to businesses of all sizes, from small startups to large corporations. It is particularly beneficial for MSMEs due to its cost-effectiveness and user-friendly interface.

Can I file multiple returns using Express GST Software?

Yes, the software allows you to file various types of returns, including GSTR-1, GSTR-3B, and annual returns. It also supports amendments and late filings.

Is my data safe with Express GST Software?

Absolutely. The software uses advanced encryption technology to ensure the security and confidentiality of your data. Only authorized personnel can access sensitive information.

Does Express GST Software provide customer support?

Yes, the platform offers an integrated help desk with live support, FAQs, and tutorials to assist users with any issues they may encounter.

How can I reset my Express GST Login credentials?

If you’ve forgotten your login credentials, simply click on the “Forgot Password” link on the login page and follow the instructions to reset your password.

Can Express GST Software be integrated with other accounting systems?

Yes, the software can easily integrate with popular accounting platforms, allowing you to sync your financial data and ensure accurate tax filings.